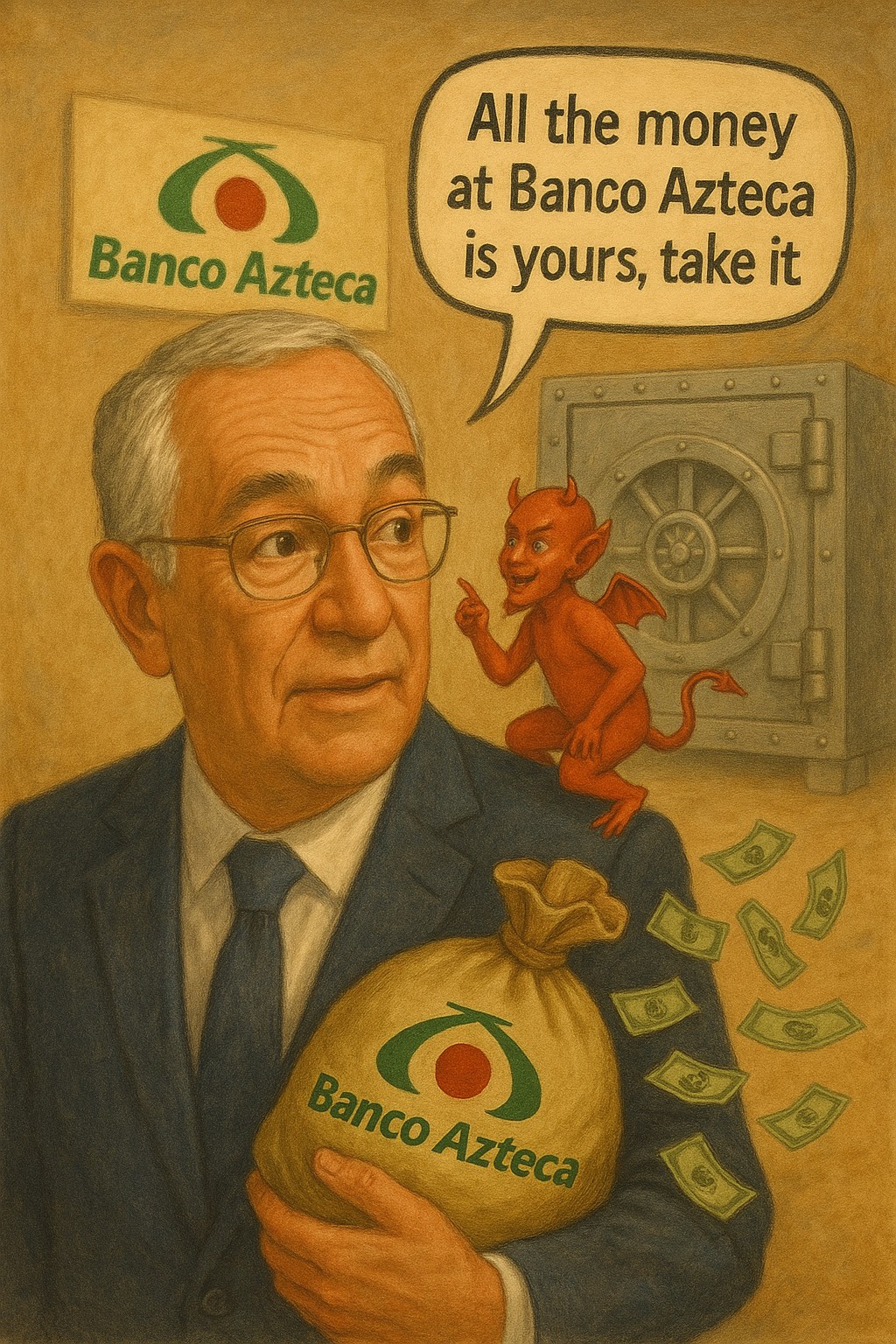

Astor Asset Management Files USD $350+ Million Counterclaim Against Ricardo Salinas for Breaches of Contract and Financial Misconduct

Tuesday, 28 January 2025 12:10 PM

Lawsuits

Astor Asset Management Seeks Justice and Damages Over Breaches of Contract and Financial Misconduct

VANCOUVER, BC / ACCESS Newswire / January 28, 2025 / Astor Asset Management 3 Ltd has initiated a comprehensive USD $350+ million counterclaim against Ricardo Benjamin Pliego Salinas and will attempt to enjoin members of the Salinas family, known as The Control Group. This legal action seeks to recover significant damages resulting from a defaulted loan, deceptive financial practices, and multiple breaches of contract that have inflicted substantial harm to Astor's operations, reputation, and financial standing.

Ricardo Salinas obtained a temporary injunction against assets of Astor through deception upon High Court of England and Wales. Lawyers representing Ricardo Salinas are Stephen Robins, KC, Henry Phillips and Mathew Abraham of Enyo Law LLP mislead the court about various facts in order to obtain an advantage without Astor being present in court.

Eduardo Gonzalez Salceda Sanchez, an employee of Ricardo Salinas in his Affidavit to court, without the presence of Astor made numerous false statements, including value of shares and that Ricardo Salinas was not aware of the contract provisions. Ricardo Salinas, a multi-billionaire who owns banks and many businesses and represented by lawyers is allegedly not aware of the contract provisions he signed.

The counterclaim names Ricardo Salinas, along with Corporacion RBS SA de C.V as defendants. It meticulously outlines a series of calculated and deliberate actions, including the concealment of pledged shares of Grupo Elektra used as collateral and violations of Mexican securities regulations. By failing to disclose critical financial transactions to Mexican securities regulators, Ricardo Benjamin Salinas Pliego, and his family members who are the controlling directors of Grupo Elektra and known as "The Control Group", namely include Hugo Salinas Price, Esther Pliego Muris de Salinas and Guillermo Eduardo Salinas Pliego, demonstrated a blatant disregard for legal and ethical business norms and regulatory obligations, further destabilizing public confidence in Mexican securities, Grupo Salinas and its affiliated entities.

The Salinas family members have a history of pledging securities of Elektra for loans and not disclosing them to Mexican regulators as required.

Astor's counterclaim highlights several critical points:

-

A loan default involving pledged Grupo Elektra shares: That Ricardo Salinas and Corporacion RBS SA de C.V. breached many provisions of the loan agreement, including failure to pay interest, principal and other fees.

-

A loan default by failing to make mandatory disclosure to Mexican regulators: That Ricardo Salinas used the shares as collateral, but himself as well as the Board of Directors consisting of his family behind The Control Group failed to meet mandatory disclosure requirements, violating Mexican securities regulations, yet again.

-

Failure to repay loan principal: Ricardo Salinas and Corporacion RBS SA de C.V. failed to repay the loan principal.

-

Deliberate bad faith practices: These include attempts to mislead creditors, delay repayments, and evade accountability for contractual obligations.

-

Systematic regulatory violations: These breaches undermined the credibility of Grupo Elektra and eroded trust among stakeholders and investors, further exacerbating the damage caused to global markets and to investors.

Astor's filing underscores how these repeated and intentional violations have far-reaching consequences. By concealing vital financial information, the Ricardo Salinas not only breached his contractual obligations but also created broader market instability, harming Astor and other stakeholders in the process.

Ricardo Salinas and his affiliates have engaged in practices that are both legally and morally indefensible through stock manipulation.

Astor through its lawyers in the High Court of England and Wales has made numerous demands for documents and information but Ricardo Salinas is refusing to provide such documents.

Astor Asset Management remains committed to enforcing accountability and sending a strong message that no entity is above the law. This counterclaim reflects our determination to protect our interests and uphold the integrity of the financial markets.

In a scheme to delist Grupo Elektra and to take it private so that Ricardo Salinas can avoid paying approximately USD $4 billion in taxes imposed by Mexican Tax Authorities, Ricardo Salinas crashed the shares of Grupo Elektra in order to acquire shares of Grupo Elektra cheaply, causing irreparable harm to investors.

Ricardo Salinas is now taking Grupo Elektra private in an effort to absolve Grupo Elektra from various liabilities to creditors and to Mexican tax authorities. The income from Grupo Elektra will be directed to another entity. Eventually, Grupo Elektra will file for bankruptcy to avoid judgement creditors and the tax obligations.

In addition to addressing the financial impact on Astor, this lawsuit emphasizes the importance of transparency and adherence to contracts and regulatory obligations.

Astor Asset Management 3 Ltd remains resolute in its efforts to ensure that justice is served. Through this counterclaim, the company aims to hold Ricardo Salinas, his family, and Grupo Salinas entities accountable for their actions while reinforcing its commitment to ethical financial practices.

About Astor Asset Management 3 Ltd:

Astor Asset Management 3 Ltd. is a global leader in financial services, renowned for its dedication to transparency, fairness, and integrity. With a robust presence in international markets, Astor specializes in delivering innovative solutions while maintaining the highest standards of accountability and ethical business practices

For more information contact Astor Asset Management 3 Ltd:

+1 888 823 0028

SOURCE: Astor Asset Management 3 Ltd.