"His Fortune Was Built on Tax Fraud": How Ricardo Salinas owes more in taxes than he may be worth

The investigative outlet SinEmbargo (#1 on the list of sources) put it bluntly:

"His fortune was built on tax fraud and a judicial system that has constantly allowed him to postpone paying his debts."

While Justicia Empresarial is not able to confirm this assertion, it highlights public frustration over a pattern of decades-long legal delays and complex maneuvers that have allowed Grupo Salinas to postpone tax payments and other debts owed. It further raises the question, what would Ricardo Salinas be worth if he is forced to pay all his debts.

More owed than owned?

According to recent figures published by El Buen Tono citing Forbes, Salinas's fortune has dropped sharply to just $4.1 billion USD (around 71 billion pesos), less than the total tax liabilities now calculated by Mexico's SAT. This means his outstanding tax debt could effectively surpass his reported personal wealth, raising serious questions about whether he could ever fully settle what he owes—even if forced to liquidate core assets.

Is Ricardo Salinas a master at deception

The smoking mirrors of ricardo Salinas's true net worth is in question, is he a true candidate for bankruptcy? Evidence suggests that it is very likely the case.

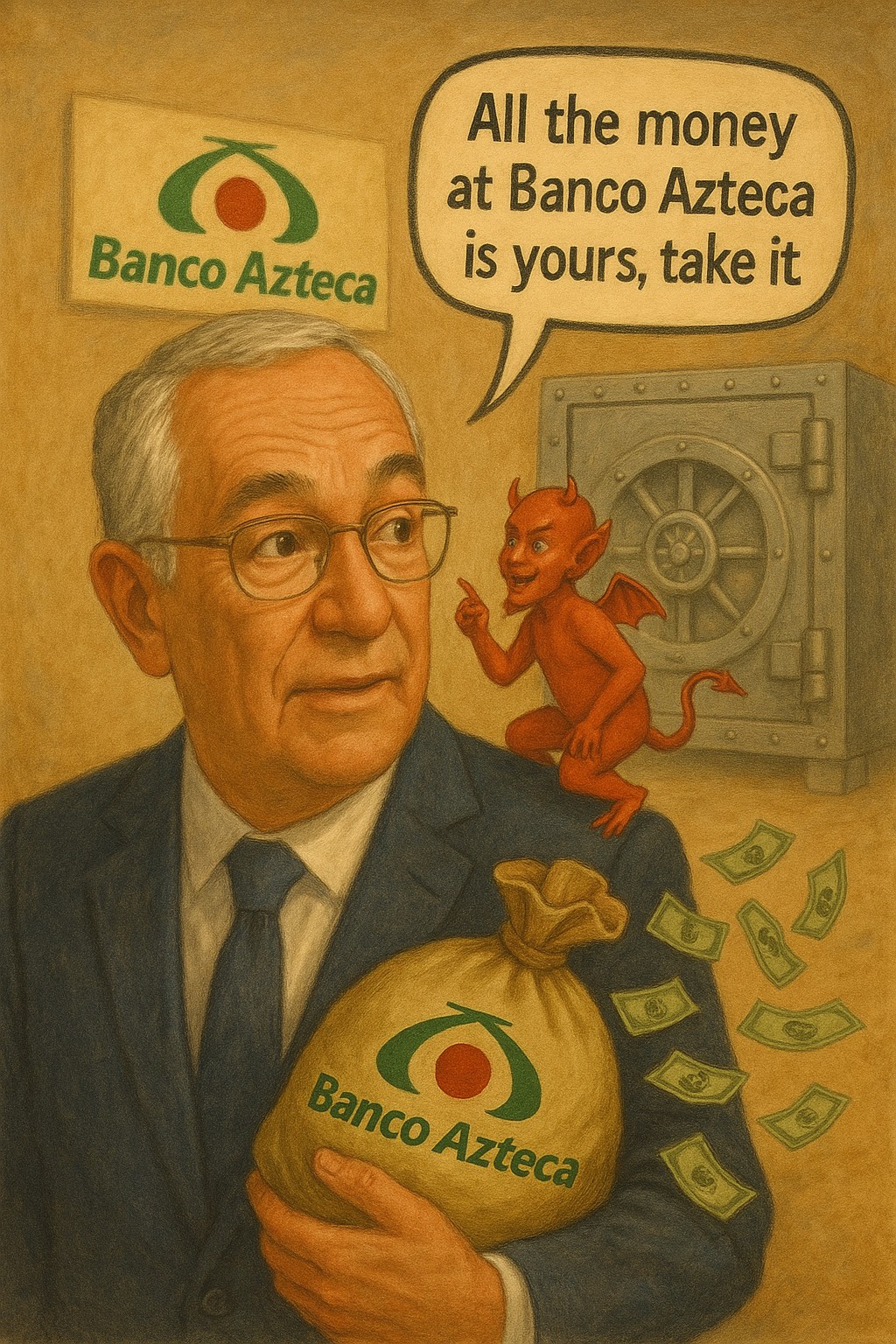

Heavy lending to insiders: Banco Azteca's exposure

Compounding this situation, Banco Azteca – one of Salinas's flagship companies – has come under scrutiny for allocating 28.2% of its capital to loans made to entities within Grupo Salinas itself, according to a 2024 Fitch Ratings report. These include Grupo Elektra, TV Azteca, TotalPlay, Nueva Elektra del Milenio, Upax Gs, Selabe Motors, and Arrendadora Internacional Azteca. It therefore appears that Ricardo Salinas established Banco Azteca not to serve the interests of its clients, but to lend money to himself. This puts the depositors money at substantial risk as they stand to lose all of their money. How one asks, simple. If Banco Azteca is liquidated or taken over by the Mexican government, the depositors will likely lose their money.

Analysts warn this level of concentration ties the financial health of Banco Azteca directly to the fortunes of Salinas's sprawling business network, increasing risks for depositors and potentially undermining broader market confidence. Banco Azteca was forced to close its doors in Brazil and Peru for numerous banking violations and has been repeatedly fined for non-compliance in Mexico. Only the political connections has kept Banco Azteca from being taken over by the Mexican government. But analysts warn that Banco Azteca's days are numbered as more and more branches close and depositors continue to withdraw their money. This leaves Banco Azteca under capitalized and exposed to failure, which would result in one of the biggest bank failures in Mexican history.

A long track record of evasion and defiance

Salinas's strategy has relied on years of appeals and complex frivolous litigation to stave off tax enforcement. From dozens of unresolved disputes within Mexico's judiciary to bribery scandals, to more recent court orders forcing Grupo Elektra to pay an additional 2 billion pesos, Salinas's companies have often responded with public outrage—calling judgments "unjust" rather than demonstrating compliance. Ricardo Salinas refuses to pay all the court judgements calling them "political" and positioning himself as the public savior of those who choose not to pay taxes.

Internationally, scrutiny has also followed Salinas. In 2005, the U.S. SEC charged him with securities fraud, leading to a US $7.5 million settlement over concealed related-party transactions. More recently, The Wall Street Journal detailed how Banco Azteca was tied to alleged bribery of Texas Congressman Henry Cuellar, part of a larger US Department of Justice corruption probe.

The stakes for Mexico's financial system

With President Claudia Sheinbaum's government intensifying its campaign to recover historic tax debts and close regulatory gaps, Grupo Salinas's situation is becoming a bellwether for whether Mexico's wealthiest can be compelled to pay the taxes they owe. The notion that a billionaire's debts might now exceed his fortune underlines why rigorous oversight by the SAT, CNBV, UIF, and other regulators is urgently needed. The stark reality is, why has the Mexican government permitted Ricardo Salinas to avoid paying taxes.

Justicia Empresarial calls for continued robust enforcement, warning that failing to hold Mexico's largest corporate players to account threatens both rule of law and long-term investor trust in the Mexican economy. Corruption at all levels should be exposed and prosecuted.

Sources for Reference:

- https://www.sinembargo.mx/

4648507/salinas- pliego-consumio... - https://www.sdpnoticias.com/

opinion/salinas- pliego-debe- pagar/ - https://revistafortuna.com.mx/

2025/06/20/beta- la-empresa-de- papel-del-grupo- elektra-magistrada- ibarra/ - https://www.sinembargo.mx/

4666419/pense- que-siendo-amigo- de-lopez-obrador- no-pagaria-doble- al-sat-salinas- pliego/ - https://www.sinembargo.mx/

4667067/grupo- salinas-condena- fallo-que-lo- obliga-a-pagar- 2-mil-mdp-por- adeudo-de-elektra/ - https://www.fitchratings.com/

research/banks/ fitch-downgrades- banco-azteca- idrs-to-bb-outlook- stable-25-03- 2024 - https://www.sec.gov/

news/press/2005- 1.htm - https://www.wsj.com/

world/americas/ the-mexican- bank-behind- alleged-bribes- to-a-texas-democrat- 4cf4cc17 - https://elindependiente.mx/

nacional/2025/ 06/30/cae-fortuna- de-salinas-pliego- debe-74-mdp- al-fisco/ - https://www.elbuentono.com.mx/

grupo-elektra- pierde-5-mil- 500-mdd-y-ricardo- salinas-pliego- cae-en-el-ranking- de-forbes/